Interview with a Bitcoin Consultant

I am fortunate to be married to Pierre Rochard for many, many reasons, two of them being his immense knowledge about bitcoin and cryptocurrency, as well as this exclusive interview he gave me! Pierre is a talented software engineer who cohosts the Noded Podcast and has a very active twitter account (@Pierre_Rochard) focused on bitcoin. Without further ado, Q&A with Pierre: Morgen Rochard (MBR): Bitcoin has two aspects to it that make it unique - software and economics. Can you explain a bit about the software to us folks that can’t code?

Pierre Rochard (PR): A protocol is a set of rules that participants agree to. For example, when playing a sport, the rules of the game would be the protocol. Bitcoin is a protocol, its rules are automatically enforced by software that can be run by anyone. You can run a node that connects to other nodes over the internet. Nodes verify that transactions (sending and receiving bitcoins) follow the protocol rules, and reject the ones that don’t.

To prevent participants from spending the same bitcoins twice, the transactions are grouped together in a block and timestamped approximately every ten minutes. This job is done by the miners, who use specialised hardware to compete against each other. The first to find a correct block wins the reward and all the fees paid by the transactions inside it; then all the miners start over.

It’s important to note that while miners do consume a lot of energy, the node software can be run on normal computers and consumes less electricity than your web browser. This enables the Bitcoin network to be highly decentralized: the protocol rules are jointly enforced (and thus determined) by a large community of people around the world.

MBR: How about the economics?

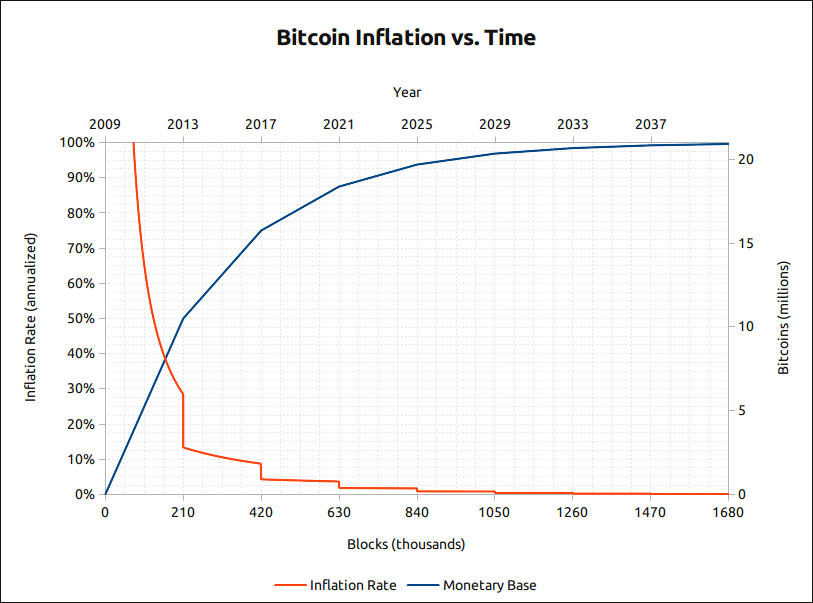

PR: Miners are incentivized by the network with newly-created bitcoins. When Bitcoin first started in 2009, 50 bitcoins were created every ten minutes. In 2012 the rate of new bitcoins being mined halved to 25 bitcoins. In 2016 it halved again to 12.5 bitcoins. The next “halving” is in 2020. These halvings are part of the protocol rules of Bitcoin: they are programmed to occur every four years, until the year 2140. At that point no new bitcoins will be created and there will only be a total of 21 million bitcoins.

Currently there are almost 18 million bitcoins, so 80% of the bitcoins that will ever exist have already been mined. This fixed supply of bitcoins means that the bitcoin price is highly volatile, because in a normal market the supply of a good would adjust with the price. It also means that the bitcoin price has been trending up over time as new buyers see the value of Bitcoin’s fixed supply and the utility of its global payments network.

MBR: Why bitcoin and not all these other cryptocurrencies?

PR: Throughout history there have been countless monies, and in each economic region one money has emerged as the “standard currency” - against which the value of all the other monies is measured. Globally today it is the US dollar, before WW2 it was the British pound, and before the 19th century it was the Dutch guilder. The standard currency emerges thanks to having the largest economic network of trade and the soundest monetary policy. Bitcoin is ahead of all the other cryptocurrencies by both of these measures. While it’s always possible that a competing cryptocurrency could pull ahead, it seems unlikely due to a heuristic called the Lindy effect: the longer a money exists, the longer we can expect it to continue to exist. Bitcoin being the oldest, it will always have a greater Lindy effect, and thus more investor confidence, than other cryptocurrencies.

MBR: There is tons of information (and misinformation) out there regarding cryptocurrencies, all of which has been driven by the intense price action we saw last year. Tell us what we should be focusing on in 2018.

PR: I see two major areas of concern for Bitcoin:

The challenge of securely holding bitcoins against increasingly sophisticated cyberthreats. For institutional investors this is being addressed with the emergence of specialized custodians. For retail investors there are now reliable hardware wallets. A hardware wallet resembles a USB flash drive and contains specialized hardware to safely store bitcoins.

The difficulty of scaling Bitcoin’s blockchain technology while keeping the network decentralized. It is relatively simple to scale the number of payments on centralized payment providers like PayPal or VISA, but Bitcoin’s blockchain is harder to scale because each node on the network needs to verify every transaction. The most promising solution is the Lightning Network protocol (video clip), which leverages Bitcoin’s network to secure a new payments network where only the sender and recipient need to verify every transaction.

MBR: Everyone knows I am a buy-and-hold kind of gal. With an appropriate allocation to bitcoin or diversified portfolio of cryptocurrencies (that are not scams), I think buy-and-hold is the way to go. Tell us about HODLing and why this is the best strategy.

PR: In December of 2013, a BitcoinTalk forum member posted a drunken, profanity-laced rant which essentially expressed her high risk tolerance and respect for the efficient market hypothesis, the title “I AM HODLING” had the infamous typo. This quickly became a meme in the Bitcoin community because it crystallized a growing sentiment that bitcoin is far from reaching its full potential, and holding it as a long-term investment through periods of high volatility was wiser than trying to time the market. There are numerous stories of bitcoin fortunes being lost with attempts at market timing, as the extreme volatility manipulates the emotions of even the most stoic traders.

Disclosures: This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. It is important to understand investing in general involves risk of loss that you should be prepared to bear. Please refer to our Firm’s Form ADV Part 2 Disclosure Brochure for more information regarding the risks of the investments held in your account. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm’s investment advisory services.