Rise of the Mega Cap

The world is an ever changing place. As we become more globalized and interconnected in the 21st century, corporations have ballooned into the age of the “mega-cap”. The first release of Apple’s iPod in 2001 marked the beginning of something great for the company. Apple shocked the world with the first generation iPhone in 2007, with its slogan “This is only the beginning”. It made headline news when Apple’s market capitalization overtook that of Exxon Mobil’s in August of 2011, only a year after the release of the iPad. The dawn of a new age of colossal technology has come upon us in only a relatively short period of time. It may seem ridiculous now, but it is highly likely that Apple becomes the first trillion dollar company, in the not so distant future. This is not an infomercial for Apple. Apple is one company of many, which started very small, nearly went out of business, and bloomed into something inconceivably large by last century’s standards.

If we look at the classifications for publicly traded companies, we have small, mid, large and mega. Small companies are generally those with less than $2 billion in market cap. Mid-size companies are generally those with market caps between $2 and $10 billion. Large companies have typically been considered as anything above $10 billion. Yet, it’s not exactly fair to compare a company like Apple ($675B) with a company like Panasonic ($26B). Both are “large-cap”, yet one dwarfs the other in size by a magnitude of 25x. Additionally, Apple is not really an outlier. There are over 43 companies in the US alone with market caps over $100B. We are truly living large!

The original Dow Jones Industrial Average was created in 1896 and held twelve companies. General Electric (now $305B) is the only company still in the index. The index now, with 32 companies, looks nothing like what it did then.

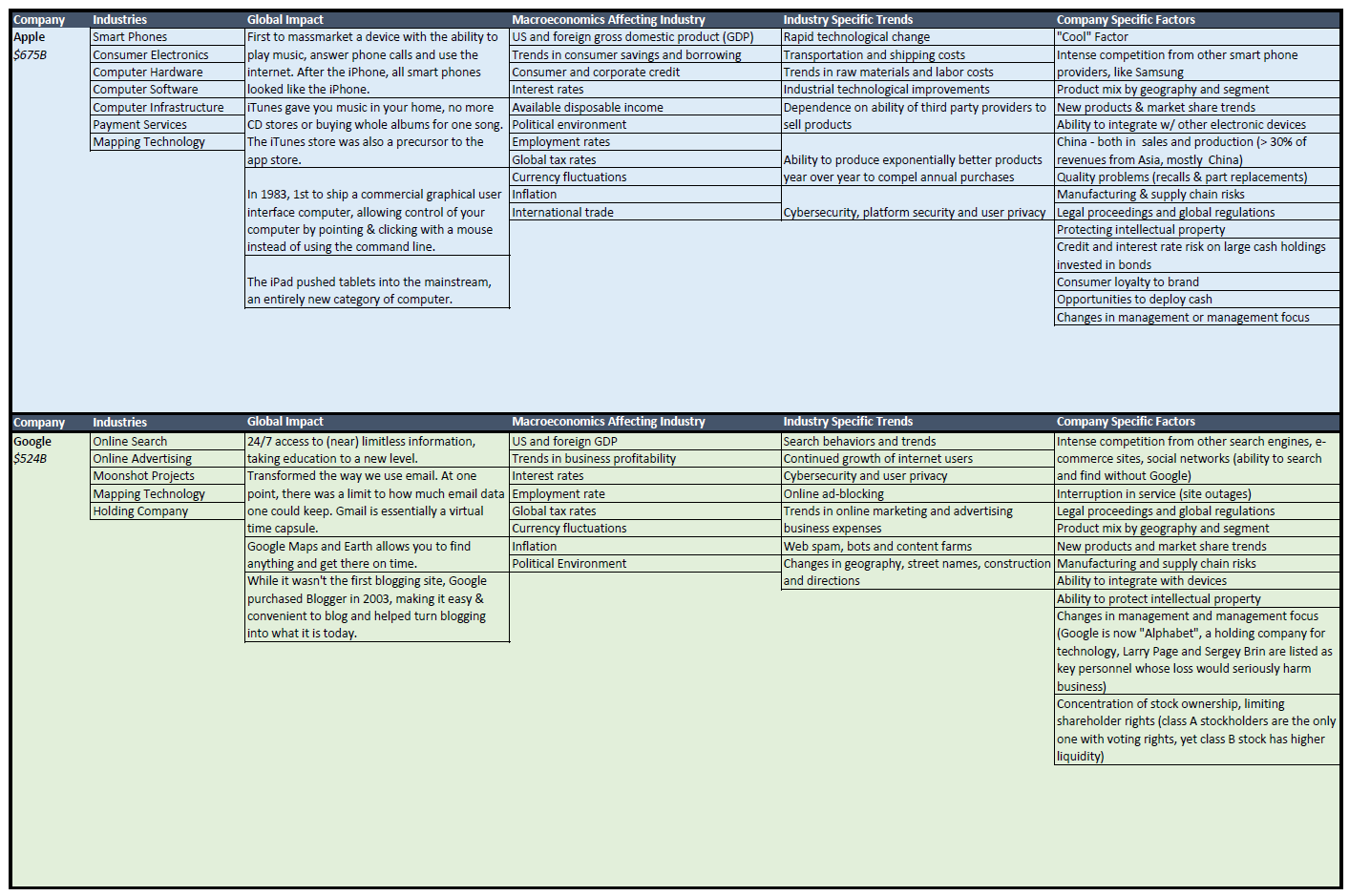

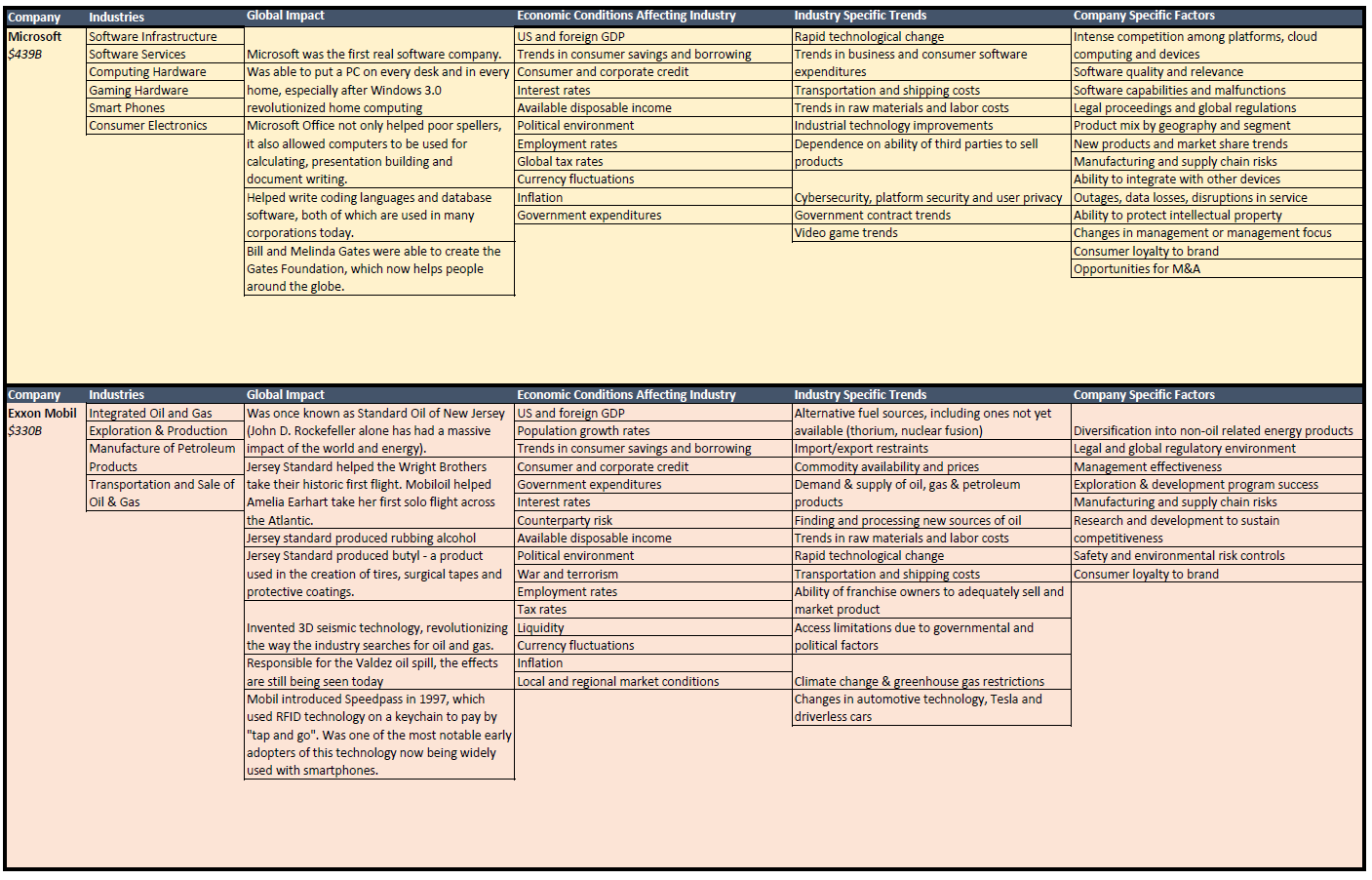

So who are these gigantic companies? The top five largest corporations currently make up nearly 1% of all global assets. The five largest companies also make up more than 3% of all equity assets. These companies are Apple ($675B), Google ($524B), Microsoft ($439B), Exxon Mobil ($330) and Berkshire Hathaway ($329B). The next segment will discuss these top five companies and the factors that affect their businesses, from macroeconomic trends to micro-company specific trends. I guarantee these five companies have greatly impacted your lives:

Disclosures This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. It is important to understand investing in general involves risk of loss that you should be prepared to bear. Please refer to our Firm’s Form ADV Part 2 Disclosure Brochure for more information regarding the risks of the investments held in your account. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm's investment advisory services.