Creating a Healthy Relationship with Your Finances

Shop (verb): to visit places (or websites) where goods (or services) are sold to look at and buy things. Overshop (verb): to visit places (or websites) where goods (or services) are sold to look at and buy things in the face of adverse consequences (long term detriment of finances, relationships and self-esteem).

We all overshop. Reflect on what you have purchased over the past month. I guarantee you can find something that you didn’t need and will rarely use. Classically, we think of the overshopper as a woman who frequently arrives home from the mall with 10-15 bags of frivolous items. Contrary to this stereotype, you don’t need to be a lady that buys a lot of clothes or shoes to be a person with an overshopping problem. You don’t even need to shop daily or weekly. For example, you can delay your retirement date with a single purchase (e.g. a boat, classic car, vacation home). Overshopping comes in many forms:

Whenever we engage in any spending behaviors, we are acting from a set of beliefs and attitudes that we learned when we were young. Generally, we are not even conscious of the underlying money scripts motivating our actions. We are robot shoppers, spending automatically, carrying out instructions from a program installed years ago.

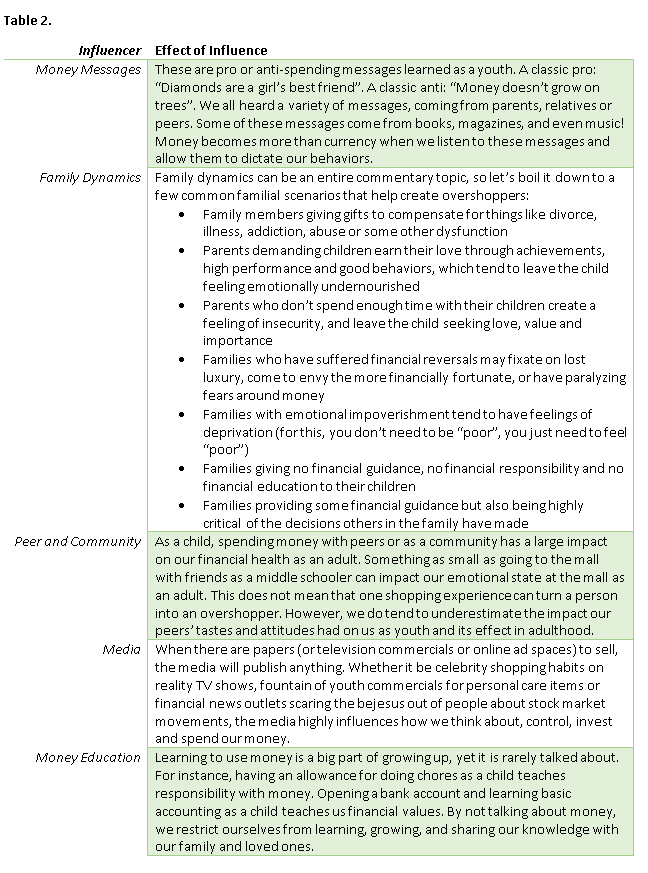

Don’t start blaming it all on your poor mom just yet! (Sorry Mom!) There are numerous ways we could have learned these behaviors in our youth:

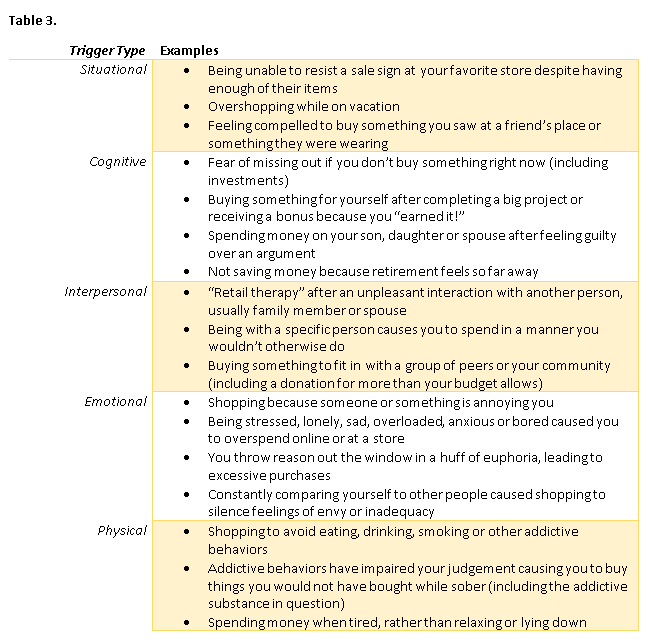

There is more to overspending than a broad psychological perspective on our behaviors. We may have had things happen to us in our past that never lead to overshopping. Instead, there is something that triggers us to spend beyond our means and ultimately hurt our long term financial health.

There are consequences to spending money outside our budgets. While the financial impact is the most measurable of these, our best-case scenario is that a little overspending only hurts the budget. Unfortunately, our finances are not typically the only things suffering after overspending. Here are some common aftershocks:

That’s an overview on overspending, its psychological impact and its long-term effects on our health. It’s important to note: there is no quick fix. Because many of our spending habits are psychological in nature, simply creating a budget and trying to stick to it is like putting a band-aid on a torn ACL. It’s going to take more than a budget to solve the problem. However, being aware of your finances is a great first step in the right direction! Feel free to use this article to recognize your own spending habits and the emotions around them. Print it out and circle or star the items that ring true to you. Come back to it in the coming months and see how your spending has evolved.

Disclosures: This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. It is important to understand investing in general involves risk of loss that you should be prepared to bear. Please refer to our Firm’s Form ADV Part 2 Disclosure Brochure for more information regarding the risks of the investments held in your account. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm's investment advisory services.