Crying Over EU

The clock is ticking as the June 23rd European Union (EU) referendum approaches. Should the UK stay or should it go? Britain’s decision to leave the EU boils down to questions of migration. Foreign born residents in the UK and Wales have doubled, from 7.3% to 13.4% of the population, in 20 years. The UK has an average of 500 people added to its population every day. A vast number of UK citizens are growing tired of the open borders of their country. These people make up the “leave-camp”. Departing the EU would result in an immediate cost savings, as the UK would no longer pay membership fees or contribute to the EU’s budget. Last year, Britain paid a net £8.5B pounds. Additionally, those in the leave-camp argue that the UK and EU can have an amicable divorce. In this scenario, Britain still has access to the EU’s single market, while still having freedom to govern at home. If it's not an amicable divorce, the EU could impose regulations and tariffs on imports of UK goods and services, a steep price to pay for maintaining a traditional sovereign nation-state in the 21st century. The popular opinion in the “remain-camp” is that without the EU, the UK risks losing their negotiating power with respect to trade deals and regulations. This may impede business deals with the rest of the EU. As a result, those in the remain-camp think the British budget and pound will be negatively affected. More importantly, the EU will be losing a major budget contributor and easy access to the London financial hub. The EU also claims that the financial advantages to remaining far outweigh the membership fee paid. If trade and investment in the UK were to fall as a result of the Brexit, this would cause job losses. The EU relinquishes control of UK internal affairs under a Brexit scenario and would have to deal with the refugee crisis on its own.

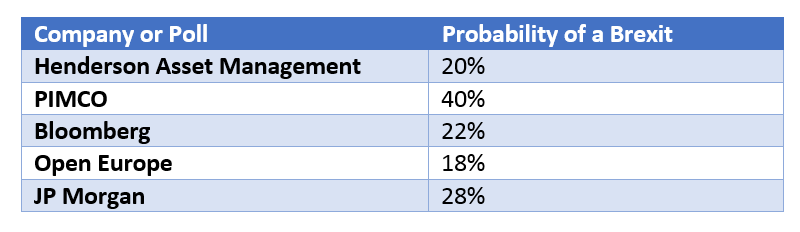

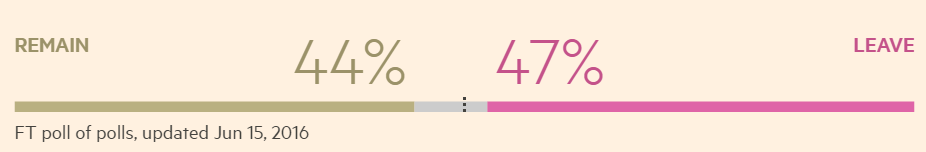

Below is the “word on the street”:

Here is the most recent polling data from the Financial Times:

The question is, must Great Britain be in the EU to thrive economically? What kind of threat are we looking at?

Facts about the UK Economy:

- 5th highest nominal GDP in the world at $2.85 trillion

- 2nd highest nominal GDP in the EU behind Germany ($3.36 trillion)

- 13th highest nominal GDP per capita

- The UK makes up 15% of the overall EU GDP and 30% of the EU equity market capitalization

- The services sector contributes 78% to overall GDP

- Second only to the US, the UK has a 17% global market share in the aerospace industry

- UK’s GDP is growing at 2.1%, versus 1.9% for France and 1.2% for Germany

UK’s Main Export/Import Partners

Great Britain definitely relies on the EU for trade.

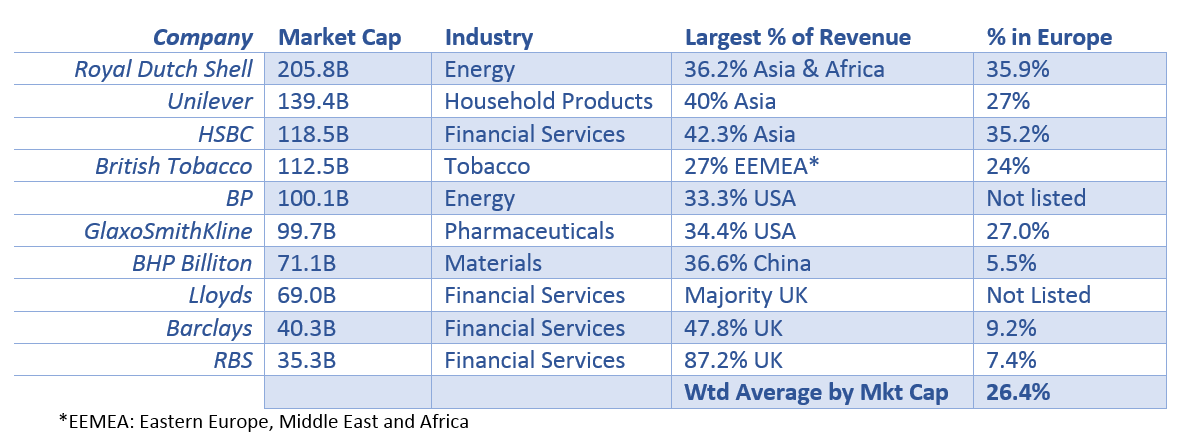

UK’s Largest Companies – where does their revenue come from? (as of 2015 annual reports)

Approximately 26.4% of revenues from the largest 10 companies in the UK come from Europe. While this is a large percentage, it is not the majority of revenues. The “remain-camp” believes if a Brexit occurs, the UK can lose a portion of their export market. Barclays stated recently that a Brexit would hit its finances and boost populist anti-EU movements in other countries. This would “open a Pandora’s box” which could lead to “the collapse of the European project”. These are strong words from a company who only gets 9% of its revenue from Europe.

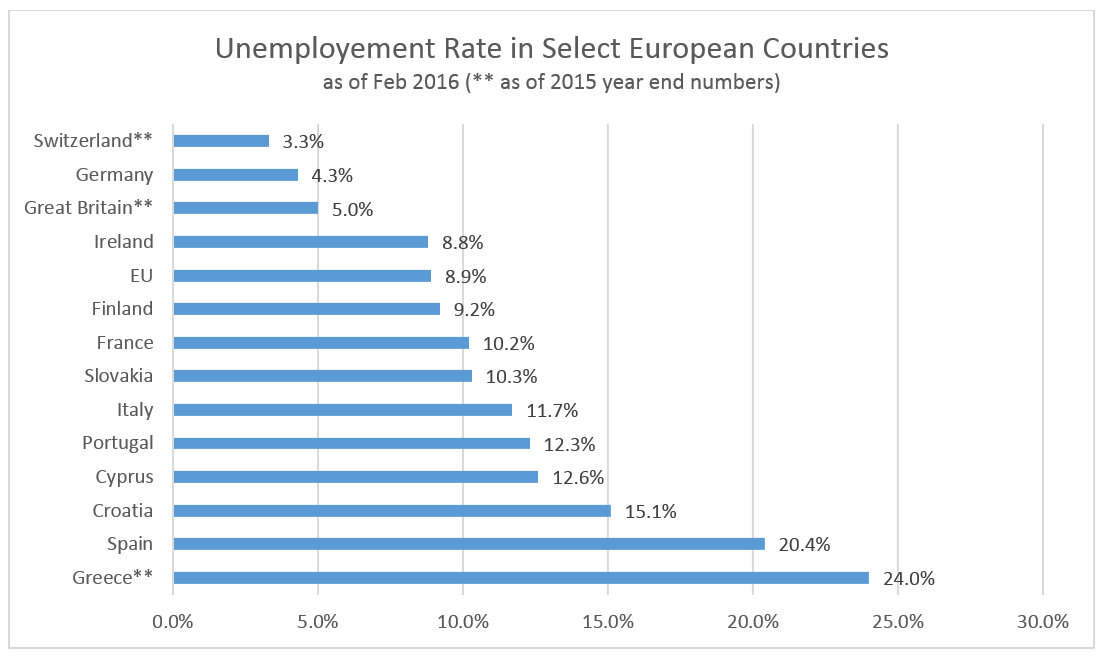

European Unemployment Rates

Unemployment in the UK is around 5%, fairly close to full employment. It is very obvious from the chart below that the EU relies heavily on the UK and Germany. Many countries within the EU continue to have a sluggish recovery eight years after the global financial crisis.

Looking to the Swiss for Guidance

Switzerland operates as a single market, not as a member of the EU nor the European Economic Area, allowing it to function independently from both groups. Through a wide range of agreements, Switzerland negotiated to become the EU’s 4th largest trading partner. The EU accounts for nearly 65% of Switzerland’s foreign trade. Like Switzerland, the UK can continue to do business with the EU thereby remaining a major player in European trade. While we can use the Swiss as an example, it is important to note the difference between Switzerland and the UK. The Swiss agreements exclude financial services. This means while the UK can look to the Swiss as an example, the accords the UK and EU will need to draft will be widely different. This is due to London being a global financial hub, to which the EU wants easy access.

Heartache for the EU

The EU undoubtedly has more to lose than the UK, should the Brexit occur. The UK currently contributes 10% of the EU’s budget. Remaining members would have to make up shortfalls or forego services and subsidies. The EU would be losing London’s global financial center along with easy access to global markets. The UK also provides military for the EU, spending 2% of its GDP on defense. The EU is also in the midst of a migration crisis. The loss of Britain means one less place to send refugees.

For those in the remain-camp, EU membership involves a worthwhile trade of sovereignty for influence. By abiding by EU rules, the UK has a louder, more influential voice on the world stage. In exchange, the UK surrenders control of internal processes. While this worked for the citizens of Great Britain for many years, the leave-camp now calls into question just how important their voice on the world stage really is.

Sources:

GDP numbers: IMF 2015

Statista charts

Unemployment rates from Eurostat

Revenue data from individual company 20Fs

http://www.bloomberg.com/graphics/2016-brexit-watch/

https://www.blackrock.com/institutions/en-us/literature/whitepaper/bii-brexit-2016.pdf

http://eeas.europa.eu/switzerland/index_en.htm

Disclosures:

This bulletin expresses the views of the author as the date indicated and such views are subject to change without notice. Our calculated perceived value is an opinion based on the information we have at the time of our forecast. The risk assumed is that the market will fail to reach expectations of perceived value. Our opinions, forecasts or predictions of future events, returns or results are subject to change and are not guarantees of future events, returns or results. This communication is intended to be distributed to current clients and certain interested parties only. This communication should not be construed as an advertisement offering our firm's investment advisory services.