“Discipline Equals [Financial] Freedom”

I admit it! I have a complete and utter obsession with Jocko Podcast, a series of audio lectures where former Navy Seal Officer Jocko Willink offers life and leadership lessons. He encourages leadership through taking ownership, being disciplined, and embracing continuous improvement. If you haven’t yet listened, do yourself a favor and “get after it”. These lessons apply directly to your financial life. “Discipline equals freedom” is a Jocko-ism. Here is the truth: financial freedom is not free. It takes painstaking efforts of self-restraint and self-motivation. What does financial freedom mean? To some it means retiring to the golf course; to others it means working or volunteering on your own terms; to everyone it means financial independence. Regardless of what you see in your future, you must work to get there. There is no easy path to achieving your financial goals.

Discipline is the root of a good financial plan. You must discipline yourself to collect your financial data for a budget that you can stick to. You must evaluate the risks in your life to make sure you have properly managed them. You must plan for the unexpected to make sure you protect your family and loved ones. You must invest in a manner that you can stick to over the long term. You must save for the future and take advantage of all options available to you.

Discipline also means understanding your behaviors and emotions to make sound financial decisions. It means checking your ego, so your ego does not derail your plan. It’s embracing the pain of nitty-gritty tasks that you know will ultimately help your future. It’s facing your fears so you can conquer them. Discipline means taking the hard road to do what’s right for yourself, your loved ones and the people who matter to you.

The easy path calls to us to be weak in the moment. We give in to our desires and gratify ourselves in the short term. Discipline will not allow that because it calls for strength, fortitude and will. It does not tolerate predilections for wants beyond your long term plan. Discipline is your best friend, who takes care of you and puts your interests first. It gives you strength, health, intelligence and happiness. It will put you on the path to financial freedom.

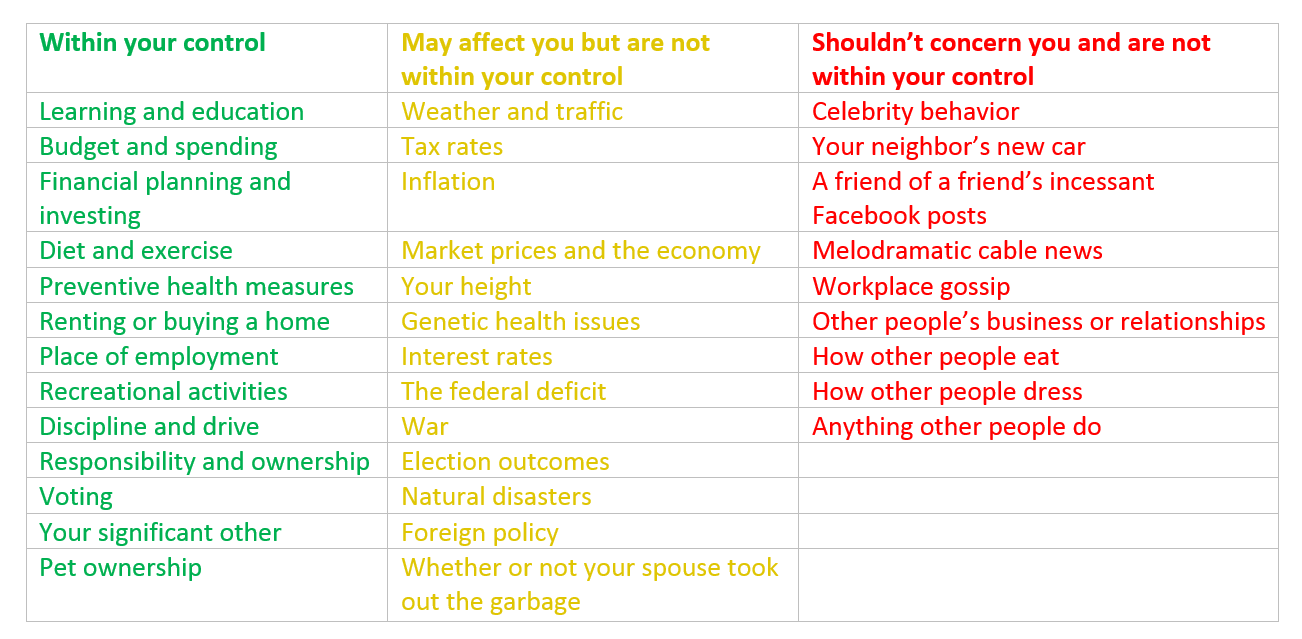

Application of this discipline means taking ownership of your life. You must focus heavily on the things you can control. The table below borrows and expands upon the concept of “Circles of Control and Concern” from Stephen Covey’s The Seven Habits of Highly Effective People:

If we focus on the yellow and the red items, we will exhaust ourselves thinking about things we simply cannot control. Let’s not waste any mental energy on anything beyond that which we have the power to change. From the table above, we should completely disregard anything in red, as these aspects of life do not apply to us directly. While the yellows may seem important, we have no influence over them. Therefore, any time spent on the yellow or the red boxes subtracts directly from the time you can invest in the green ones. We must discipline ourselves to invest our best hours in the greens, because these are the aspects of our lives we can understand and change. As we exercise discipline over time, we will achieve the goals most important to us. This discipline translates into freedom.

The best way to start taking ownership over your finances is to understand what you are doing and why you are doing it. What are your goals? You can start by looking at the table below and then ranking them in importance for yourself, 1 being least important, 10 being the most:

Once you have your goals and have ranked them, you understand their strategic importance. You can start your plan because you know what you are doing and why you are doing it. The principles of financial planning do not change over time. However, the nuances change from person to person. Your list may look very different compared to your best friend’s list or a family member’s list. That is why we can’t blindly follow others when we create a plan. It must be tailored to our needs, our goals and our expectations. We take ownership of our plan.

The best time to start is: now. It is never too late to be in control of your finances and your life. Our age, amount of money or level of readiness does not matter. Time continues to pass regardless of whether or not we tackle our goals. If you would like to improve your finances or your budget, the best time to start is now. If you’d like to manage risk, whether it be investment, life or longevity, the best time to start is now. If you want to have ample funds for retirement, start now. If you would like to be in business for yourself, save for your children’s future or make sure you can take care of your aging relatives, you need to start here and now. Let’s stop making excuses. Let’s stop over-researching and over-thinking, instead of taking the reins. There is no shortcut; take the first step and make it happen. As Jocko would say, “get after it”.